How to Choose the Best Payment Gateway in India

You can take a deep breath if your targeted customers are not from India as you can use PayPal which takes only 10 minutes to implement a payment gateway on your website. First 1 minute for signup, next 5 minutes to edit your profile, add your bank details & other info & next 4 minutes to create a ‘Buy Now’ button, get the code & place it on your ‘website in ‘Order Now’ page.

With in 10 minutes, you can start receiving payments through your website if customers pay you from outside India.

But, if your customers are from India, its a real pain. Although there are dozens of payment gateway in India but to make it work on your website, it takes more than 10 minutes, no no more than 10 hrs, no no more than 10 days.

Really, its very confusing & time consuming & that is when I decided to write this post. I will try to help you out in my own way so that you can understand how to choose a payment gateway.

How to choose the best payment gateway in India

There are many points other than the cost factor which are useful in choosing a good payment gateway in India. Just read them in details below so that you know how to decide one that fulfils your need.Cost

Unlike PayPal, all payment gateway in India comes at a hefty price. You have to pay 3 types of costs, no matter what payment gateway you choose. First, you have to pay a fixed setup fee, then annual maintenance cost of the software & then the charges of 3% to 7% on every transaction.Due to competition, many online businesses operates on low margin. How much the payment gateway charge per transaction will decide, how much profit you will make at the end of the month. So initial setup cost & operating cost will make a difference in choosing your payment gateway in India.

Support

Every minute counts in online business. You may lose many customers, if the payment gateway fails even for 1 hour. If there comes any problem in your payment gateway, there must be a dedicated technical person that can help you out to identify & solve the problem. More time they will take to support you, bigger will be your loss.One of the important thing, you can check here is the physical address of the company in your city & how far is this from your place.

Payment Options

You need to find out which are the largest payment methods people use in India. Whether its netbanking, debit card or credit card. If net banking then which bank & if credit card or debit card then which card etc. If the payment gateway, you want to go with, does not support a particular method then you can decide, how much business you can lose.Ease of Integration

How easy is to integrate the payment gateway in your website. Right from the initial enquiry to the integration on your website, how comfortable is this to work with a payment gateway. Whether it works with all CMS like WordPress, Drupal, Joomla etc.Check that if they require anyone in your company to have knowledge of any programming language or if by integrating their gateway, you have to do any major changes in your website.

Ease of Use

One of the thing, I hate is, paying online through credit card on Indian sites. It takes a lot of extra effort to make the payment through Indian payment gateway.One of the major problem I see is, payment will be debited from your account but you will get the message of unsuccessful payment. You will be scared of making payment again due to failure. IRCTC, Bookmyshow, Utility bill payment sites etc. are some of the best examples. So transaction success rate may play a very important role in your business

Then another major problem comes with 3D secure password. Most of the people do not remember their 3D secure passwords. They have to create a new one to make the transaction successful. Many people lose interest at this stage.

So make your visitors happy by giving them a simple & easy to use payment gateway with higher success rate.

Chargeback Policy

How your payment processing company handles & supports for chargeback. What, if the product is delivered but you received the chargeback. So your payment gateway must provide good support in your favor to fight the chargeback.Trust

Sometime, people decide to buy or not, by seeing your payment gateway. Which is the most trusted payment gateway company? How your customers feel about the payment gateway? What’s their trust level?Other Features

Apart from these, what are other features, your payment gateway is providing. Some of them are like –- if they support all types of mobile payment

- it provides easy reporting of your account.

- if it’s highly secured

- it handles recurring payment automatically

- it provides multiuser account with different permission level.

- and many other that your business need.

| Company Name | One Time Setup Fee |

Transaction Charges | Annual Maintenance Cost(AMC) | Credit Cards supported | Banks & DC Supported | Company Link |

| 7500/- 25,000/- 40,000/- |

7%, 5% & 1.25% for Credit Card, Netbanking 4% 5 Debit Card 1.25% | 1200/- 2400/- 3600/- |

Visa,Master Card, Amex, Diners, JCB | 45 Banks including all Major banks | CC Avenue | |

| 12,000/- 18,000/- 24,000/- 30,000/- |

5% 4% 3.75% 3.25% |

3600/- 3600/- 3600/- 3600/- |

Master Card, Visa, Diners Card | Axis Bank, HDFC Bank, ICICI Bank, J & K Bank, Citibank | EBS | |

| |

15,000 | 5% | 2400/- | Visa, Master Card | 34 banks & 51 debit |

DirecPay |

| 50,000 | 3.5% to 6% | 12,000/- | Visa, Master Card | HDFC | ||

| 30,000 | 3% to 4% | no | Visa, Master Card | ICICPaySeal | ||

| 6,000/- | 6% | 2400/- | Visa, Master, Diners |

Axisbank | ||

| Nil | 5% | Nil | Visa /Master | No | Transecute | |

| 6,000/- 12,000/- 24,000/- 36,000/- |

4.9% 3.9% 3.25% 2.75% D card – 1.25% |

Visa & Master card | 2400/- | 50 banks | PayU | |

| 3,000/- 10,000/- 25,000/- |

5% 4% 2.75% |

1,500/- 2,500/- 5,000/- |

Visa, Master, JCB, American Express | 15 banks | PaySignet | |

| 5,000/- |

5- to 50L – 2.5%

50+ Lacs 2.25%

2.25%6,000/-

NilMajor credit cards & debit cardsNilZaakpay

I hope you have got some understanding of how to choose a good payment gateway for your online business. Although many people prefer to go with either CC Avenue or EBS, there are many other good options depending on your own criteria.

Do your own research before you come to a final conclusion as changing a payment gateway is more difficult than taking this first time.

Tip – You can also consider about the cash on delivery option (COD), as this is one of the biggest method people use on internet to purchase something. They feel very secured with this way of payment.

Write your opinion & share your experience so that other people can get the benefits for choosing a payment gateway.

Looking for the best

payment gateway for your business in India? Choosing the perfect payment

gateway for your business is a critical task. Here is a list and

comparison of payment processing companies which are the best in market.

Some of these companies offer service with no setup fee. Such options

are good for startup businesses that are still testing the waters.

Last month, I was working on a new project. The work involved implementation of a payment gateway. So, before implementation, the obvious task was to find out which are the best payment gateways in India. I did some research on this subject. And here are a few answers and pointers.

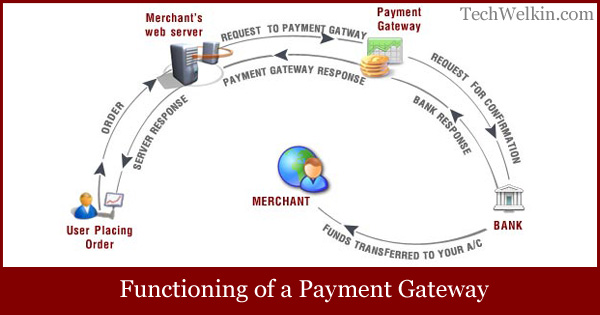

What is a Payment Gateway?

In simple terms, payment gateway is a service that authorizes the credit card or other forms of electronic payments

like online banking, debit cards, cash cards etc. Such a facility is

not only important for huge and well established businesses —but also

these are useful for home based online entrepreneurs.Payment gateway acts as a middleman between the bank and the merchant’s website or mobile application. When a user wishes to make a payment, the merchant’s website sends the encrypted credit card information to the payment gateway. Then the payment gateway confirms the validity of these details with the bank and the required amount of money gets transferred from user’s account to the merchant’s account.

Functioning of a payment gateway

Best Payment Gateways in India

Following

are the best payment gateway service providers in India. These gateways

have been selected on the basis of their market share, commission

charges and reputation of promoters etc. Please note that these payment

gateways are not given in any particular order. To stay in competition,

these companies keep on revising their commission fee and also make

discount offers from time to time. It is advisable that you visit their

websites to get to know the on-going discount offers.If you’re a startup entrepreneur or a freelancer which sells digital products like eBooks, music, videos, tutorials etc. then InstaMojo is a very good choice for you.

InstaMojo is an Indian startup company setup by Aditya Sengupta, Akash Gehani, Harshad Sharma and Sampad Swain in 2012. They offer seamless payment collection facility at attractive rates. InstaMojo can host your digital content and you can provide a “Buy Now” button on your website. On clicking this button, the customer will be able to buy your product without even leaving your website!

Instamojo charges 1.9% of the successful transactions. If you want to host your content on their website, they will charge 5% of the transaction. InstaMojo will collect the money on your behalf and send the amount in your bank account within 3 business days. For example, if you price a song at Rs. 100 and sell it through InstaMojo, you will get Rs. 97.83 in your bank account. InstaMojo will deduct Rs. 1.9 as their fee and Rs. 0.27 as service tax.

InstaMojo does not charge any setup fee.

PayU India is a subsidiary of the global firm PayU. It was launched in 2011 by Ibibo, which is co-owned by Naspers and the Chinese Internet service portal Tencent. PayU also has presence in countries like South Africa, Hungary, Poland and Russia among others. PayU can process payments with Visa, MasterCard and Diners credit cards; debit cards of more than 50 banks; and online banking for banks including ICICI, HDFC, SBI, and Axis Bank. Here is the rate list of PayU India:

- Debit Cards

- Rs. 2000 or less: PayU will take 0.75% commission

- More than Rs. 2000: PayU will take 1% commission

- Credit Cards, Online Banking or Multi-bank EMI

- Upto Rs. 4,900: Commission is 3.90%

- Upto Rs. 9,900: Commission is 3.25%

- Upto Rs. 19,900: Commission is 2.90%

- Upto Rs. 29,900: Commission is 2.50%

- Amex, Cash Cards and PayUMoney

- Upto Rs. 4,900: Commission is 3.90%

- Upto Rs. 9,900: Commission is 3.25%

- Upto Rs. 19,900: Commission is 3.25%

- Upto Rs. 29,900: Commission is 3.25%

Setup fee of PayU India

PayU India charges from Rs. 6,000 to Rs. 36,000 as setup fee. Fee varies on the basis of various plans that they offer:

- Setup fee for Economy plan: Rs. 6,000

- Setup fee for Silver plan: Rs. 12,000

- Setup fee for Gold plan: Rs. 24,000

- Setup fee for Platinum plan: Rs. 36,000

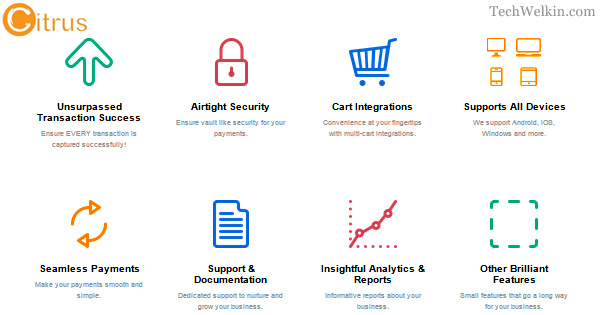

CitrusPay has an interesting commission scheme, they charge a flat 1.99% + Rs. 3 for every transaction made through them. CitrusPay charges Rs. 1,200 towards annual maintenance fee. They claim to be able to capture EVERY single payment and therefore have a very high conversion rate. Citrus is also known for the good levels of security through transaction process. Their technology is world class.

Features of Citrus Payment Gateway.

If you decide to use Citrus as your payment gateway, you wouldn’t have to worry much. An easy sign-up will give you the code to embed payment form from Citrus in your website. After sign-up, you can send the required documents in two weeks time. Once your documents are received and verified by Citrus, your payment gateway will begin to function.

CitrusPay was incorporated in 2011 by Satyen Kothari and Jitendra Gupta. Now it has a great market reputation and an enviable list of clients.

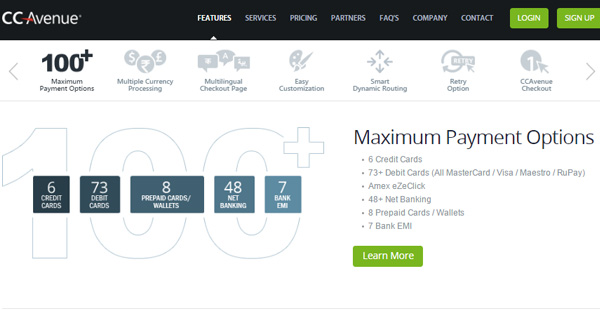

CCAvenue is the biggest payment gateway in India with over 80% of e-commerce merchants in Indian market are using their services. They offer a large number of payment options:

- 7 Credit Cards (MasterCard, Visa, American Express, JCB, Discover, Diners Club, eZeClick)

- 73+ Debit Cards (All MasterCard / Visa / Maestro / RuPay)

- Amex eZeClick

- 48+ Net Banking

- 8 Prepaid Cards / Wallets

- 7 Bank EMI

Another great feature that CCAvenue offers is the multilingual check-out page. Majority of Indian e-merchants don’t yet recognize the importance of languages other than English, but trust me, regional languages are extremely important. Not everybody is comfortable with English in India. CCAvenue allows customer to see the check-out page in the language that they understand the best. They offer interface in 18 major Indian and International languages.

Now here are the commission rates that CCAvenue charges:

- Popular Plan of CC Avenue

- Setup fee = Rs. 0

- Annual Maintenance Fee = Rs. 1,200

- MasterCard / Visa / Diners Club Credit Cards: CCAvenue will charge 3.5%

- Debit Cards: 1.25% commission

- Net-banking: 4.0% commission

- American Express / JCB Cards: 5.0% commission

- Cash Cards: 5.0% commission

- Privilege Plan of CC Avenue

- Setup fee = Rs. 30,000

- Annual Maintenance Fee = Rs. 3,600

- MasterCard / Visa / Diners Club Credit Cards: CCAvenue will charge 2.25%

- Debit Cards: 1.25% commission

- Net-banking: 2.5% commission

- American Express / JCB Cards: 3.6% commission

- Cash Cards: 3.6% commission

EBS is a company owned by France-based Ingenico Group, which is a global leader in the payment processing and services. EBS has offices in Delhi, Mumbai, Kolkata, Chennai and Bangalore. They have several plans for you to choose from and commission rates for net-banking and credit cards range from 2.75% to 3.75%. For debit cards EBS takes 1.25% to 1.50% commission.

A minimum setup fee of Rs. 11,999 and annual maintenance fee of Rs. 2,400 is also to be paid. EBS gets mixed reviews from users about their quality of service.

PayPal is not just any other payment gateway! When it started, it was a revolutionary idea of sending money through email. For small online businesses, PayPal is a great option. Those who can not afford other means of payment processing, PayPal provides them a simple and inexpensive way of doing business. I have written an article on how PayPal works, you can read it to get a better understanding.

If you’re selling any service or product on your website, PayPal can bring payment from your buyer into your bank account —and PayPal takes 4.4% + $0.30 USD commission for this. If you’re selling through eBay, then PayPal charges only 3.9% + $0.03 USD.

If you’re earning from online business, you can request payment from your buyer through PayPal. You can also send money through this service. It’s easy, simple and effective.

Update: Flipkart has shutdown PayZippy and instead they are now investing money in ngpay.

This new kid of the block has been developed by Flipkart —the leader in the Indian e-commerce industry. PayZippy offers you easy interface for integration into your website. They have plug-ins for several popular platforms, including WordPress, Magento, OpenCart, ZenCart, PrestaShop etc. SDKs are available for PHP and Java.

If you want to integrate PayZippy into your mobile app, they have made ensured that you will not have to toil much on the development. An extensive PayZippy API will ensure that you can do seamless integration of payment gateway in your mobile app.

Here is the list of PayZippy charges:

- VISA, Mastercard and Maestro Debit Card Pricing

- Rs. 2000 or less: PayZippy commission would be 0.75%

- More than Rs. 2000: PayZippy commission would be 1%

- VISA and Mastercard Credit Card / Net-Banking Pricing

- Rs. 0-5 lakhs: PayZippy commission would be 3.50%

- Rs. 5-10 lakhs: PayZippy commission would be 3.25%

- Rs. 10-25 lakhs: PayZippy commission would be 3.00%

- Rs. 25-100 lakhs: PayZippy commission would be 2.50%

- Rs. 1 Cr or above: Contact PayZippy to get rates

- American Express Cards

- PayZippy commission would be 3.50%

- International Credit/Debit Card Pricing

- Domestic fee + 1.50% over and above that

PayZippy can optionally save customer’s card details so that the next time he can swiftly make payments. PayZippy APIs allow you to integrate card details form right in your own website.

I hope this list of best payment gateways in India will help you in selecting a suitable payment gateway for your business. Selecting the right payment gateway is an important decision to make. So, I would advise you to take your time, do your research and then make an intelligent decision.

Should you have any questions in this regard, please feel free to ask in the comments section of this article. I will be happy to try and help you. Thank you for using creativejob33.

No comments:

Post a Comment